Crafting a Winning Accounts Receivable Cover Letter

A well-crafted accounts receivable cover letter is your key to unlocking the door to your dream job. It’s more than just a formality; it’s your opportunity to make a compelling first impression and showcase your skills and experience. This guide provides the top secrets to help you create a cover letter that stands out from the competition and grabs the attention of hiring managers. From highlighting your key responsibilities and essential skills to structuring your letter and avoiding common mistakes, this article will equip you with the knowledge and tools you need to succeed. With the right approach, your cover letter can transform from a daunting task into a powerful tool in your job search arsenal. Remember, the goal is to demonstrate why you are the perfect fit for the role and how you can contribute to the company’s success. Let’s dive in and unlock the secrets to crafting an accounts receivable cover letter that gets results.

Understanding the Accounts Receivable Role

Before you begin writing your cover letter, it’s crucial to understand the accounts receivable role. This understanding will inform the content and focus of your letter, making it more relevant and impactful. Accounts receivable specialists are vital to any organization’s financial health, responsible for managing and collecting payments from customers. This role requires a keen eye for detail, strong organizational skills, and excellent communication abilities. Being able to articulate your understanding of these responsibilities in your cover letter will immediately set you apart. Emphasize your knowledge of the financial cycle, from invoicing and payment processing to reconciliation and reporting. Demonstrate your ability to manage customer accounts, resolve payment discrepancies, and maintain accurate financial records. Remember, the hiring manager wants to see that you understand the intricacies of the role and how your skills align with the company’s needs.

Key Responsibilities in Accounts Receivable

The core of the accounts receivable role revolves around several key responsibilities. These include creating and sending invoices, tracking payments, following up on overdue accounts, and reconciling accounts. You’ll also be responsible for handling customer inquiries related to billing and payments, processing credit applications, and maintaining accurate financial records. Additionally, accounts receivable professionals often play a role in preparing financial reports and assisting with month-end and year-end closing processes. Understanding these responsibilities is essential to showcasing your expertise. Include phrases that show your experience in each of these key areas. This demonstrates to the hiring manager that you’re well-versed in the day-to-day tasks and strategic objectives of the role. In your cover letter, it’s crucial to use specific examples of how you’ve handled these responsibilities effectively in past roles.

Essential Skills to Highlight in Your Cover Letter

Your cover letter should highlight a blend of technical and soft skills to make you a strong candidate. Emphasize your proficiency in accounting software, your experience with accounts receivable processes, and your ability to maintain meticulous financial records. Equally important are the soft skills that will make you a well-rounded employee. Communication, problem-solving, and organizational abilities are crucial for success in this role. Moreover, you should also emphasize your attention to detail, as accuracy is paramount. The combination of these skills will show potential employers that you possess the complete skillset for the job. Remember to tailor your skills to match the job description’s requirements, so your letter clearly reflects the employer’s needs. This targeted approach will help you make a memorable impression on the hiring manager.

Technical Skills

Technical skills are essential to demonstrate your competence in accounts receivable. You should highlight your proficiency in accounting software such as QuickBooks, SAP, or Oracle, or any other software mentioned in the job description. Mention your experience in using spreadsheets (like Excel) for data analysis and reporting. Your ability to handle various payment methods and reconciliation processes should also be highlighted. If you have any specialized knowledge, such as experience with credit and collections, be sure to include that as well. Additionally, consider including any certifications or training related to accounting or finance that could add credibility to your application. Make sure that your technical skills clearly align with the job description, so the hiring manager can immediately see your qualifications.

Soft Skills

Soft skills are just as vital as technical skills in accounts receivable. Highlight your communication skills by emphasizing your ability to clearly and professionally interact with customers and colleagues. Demonstrate your problem-solving abilities by providing examples of how you have successfully resolved payment discrepancies or other financial issues. Show your organizational skills by detailing how you manage multiple accounts, meet deadlines, and maintain accurate records. Also, don’t forget to mention your attention to detail, as accuracy is critical in this role. These skills will give the hiring manager a more complete picture of your skills. Remember, showcasing your soft skills can significantly enhance your chances of landing an interview, as it shows you are capable of working within a team.

Structuring Your Accounts Receivable Cover Letter

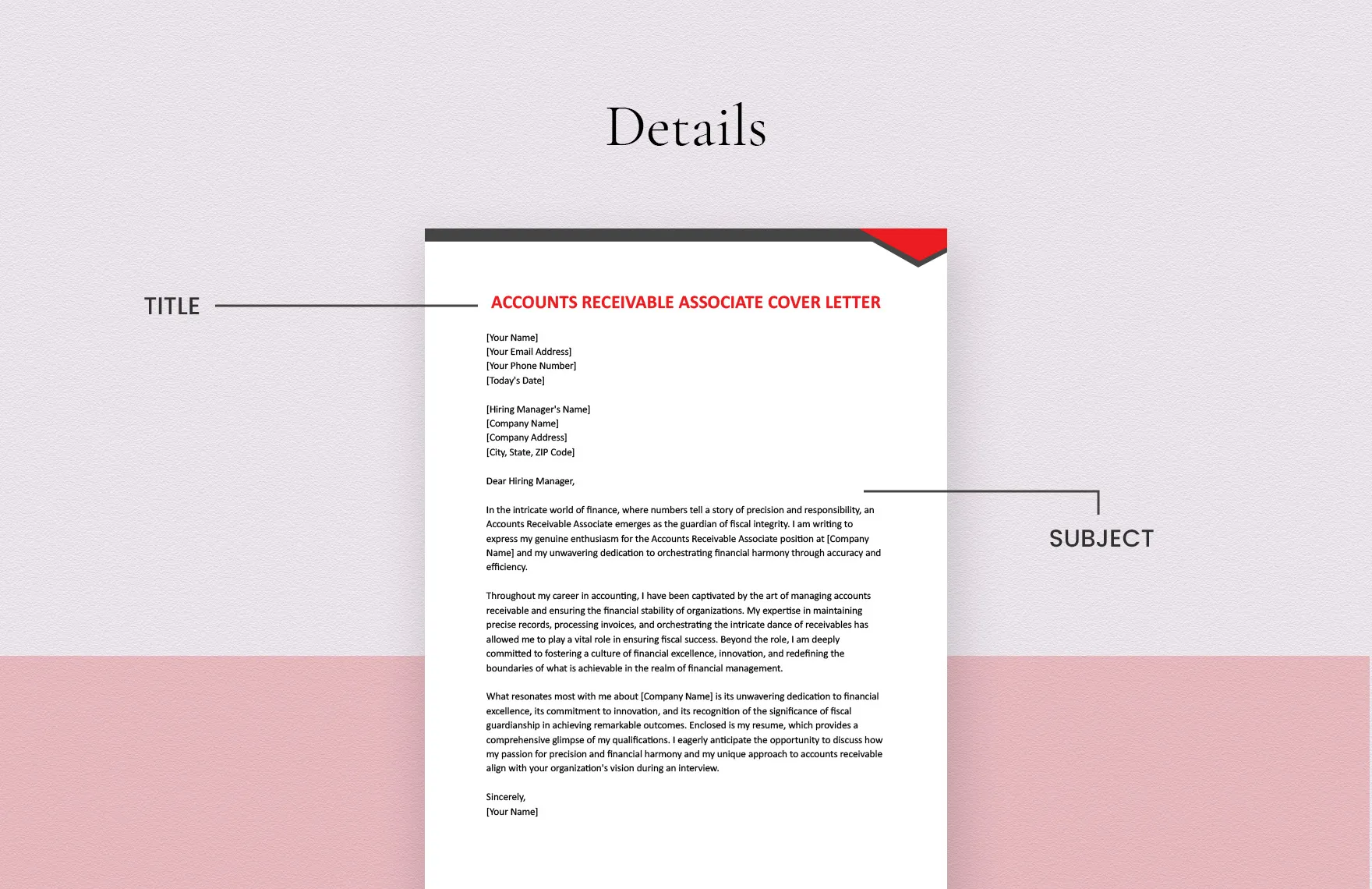

A well-structured cover letter is crucial to keeping the reader engaged. The standard format includes a header, a greeting, an introduction, body paragraphs, and a call to action. Each section should be carefully crafted to convey your skills, experience, and enthusiasm for the role. It’s important to maintain a professional tone throughout the letter and make sure that the content is easy to read and understand. A clear, organized structure guides the reader and allows them to quickly grasp your qualifications and enthusiasm. Tailoring each section to match the specific requirements of the job is important, so your cover letter leaves a lasting, positive impression on the hiring manager. A well-structured cover letter not only presents your qualifications effectively but also shows your attention to detail and professionalism.

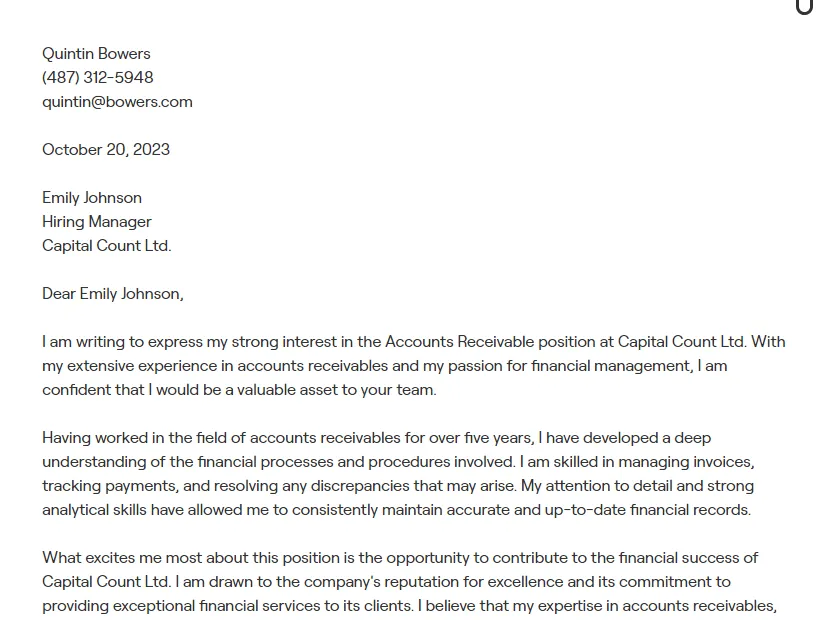

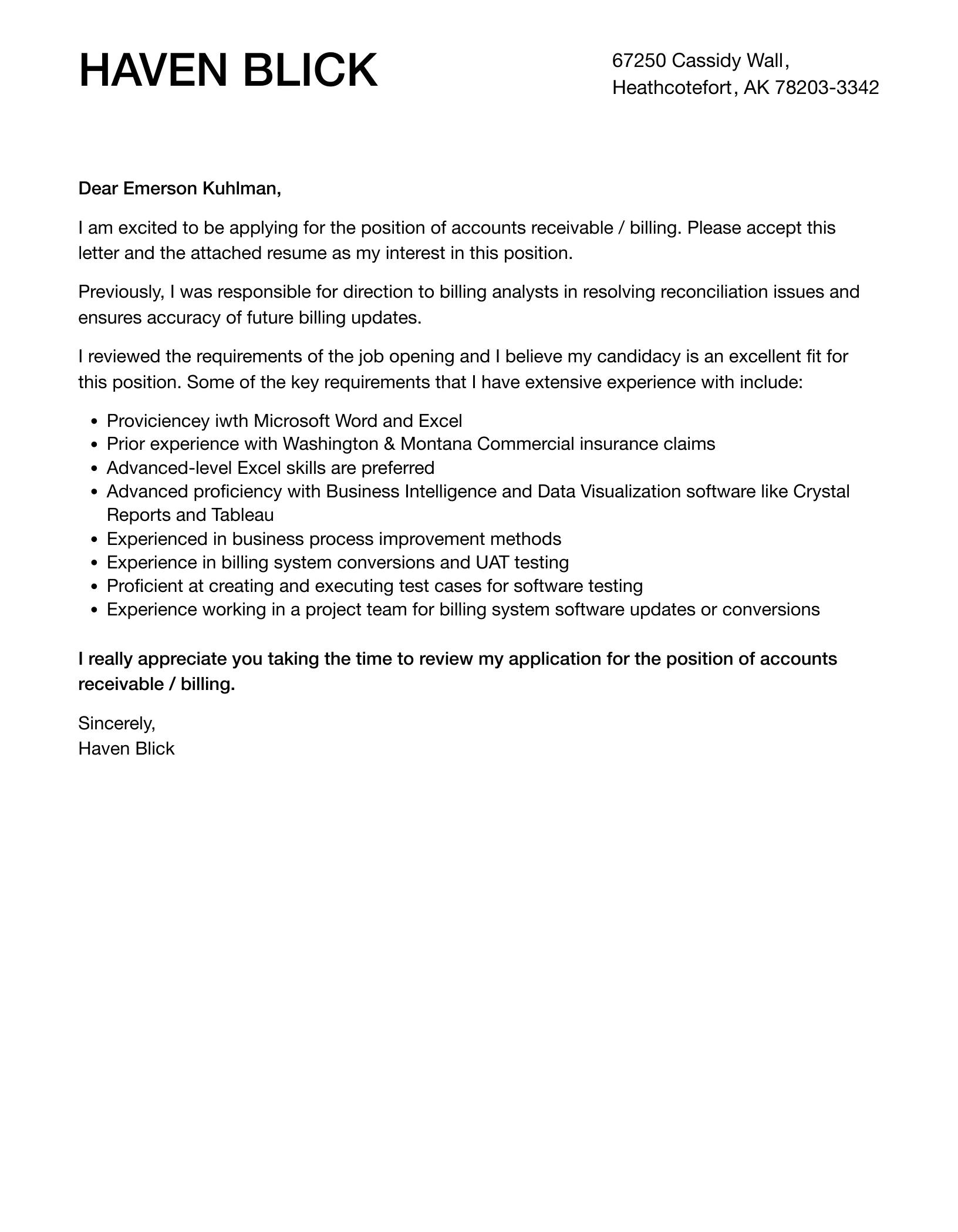

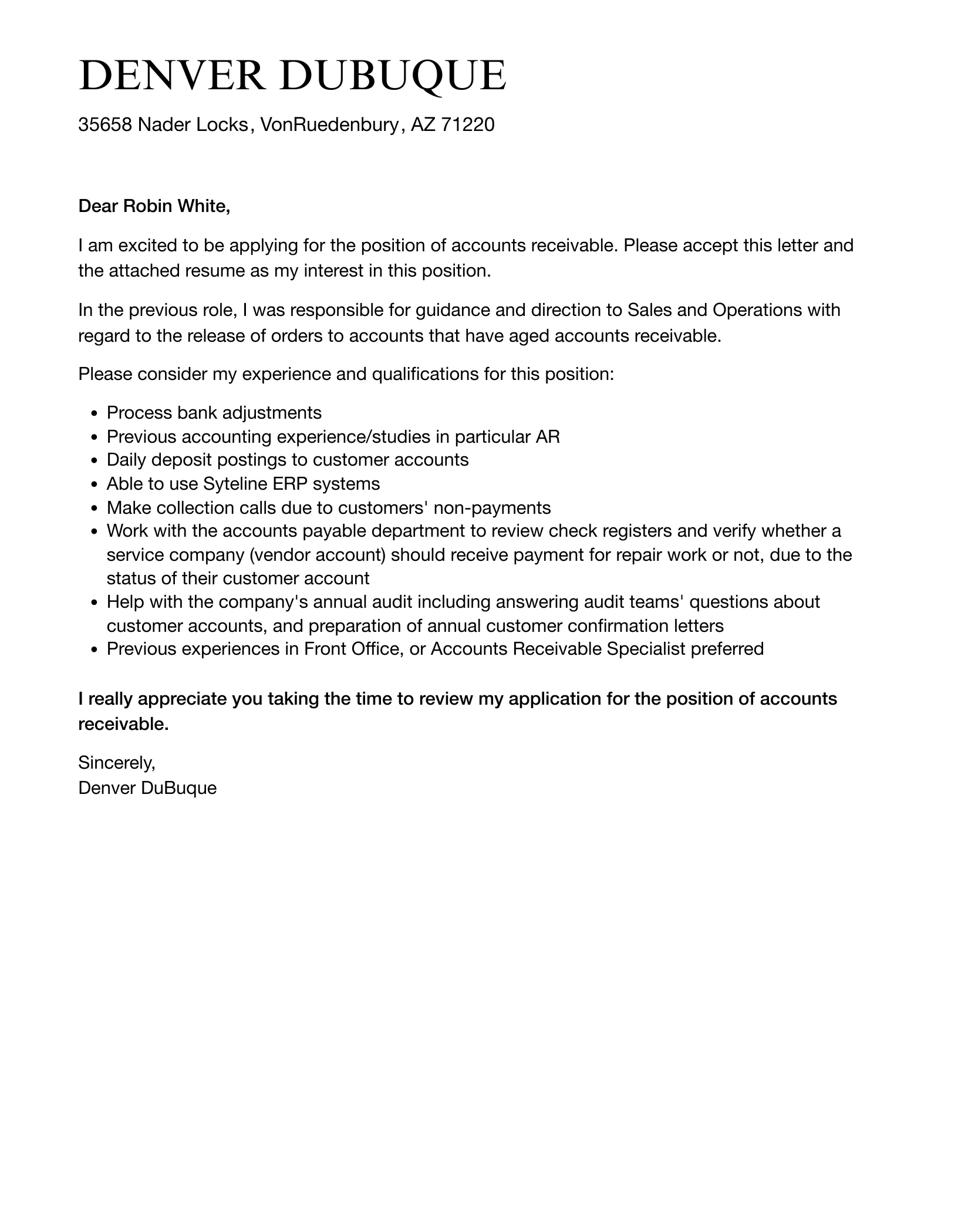

Header and Contact Information

Start your cover letter with a professional header that includes your contact information. This should typically consist of your full name, address, phone number, and email address. If you have a LinkedIn profile, you can also include the URL. Make sure your contact information is current and accurate, so the hiring manager can easily reach you. Including your name in a slightly larger font size at the top helps the reader quickly identify you. This ensures that your contact details are easily accessible, making it simple for the hiring team to get in touch with you if they decide to move forward with your application. Consistency and professional presentation will help make a good first impression, demonstrating your attention to detail.

Greeting and Introduction

Begin your cover letter with a professional greeting, such as ‘Dear [Hiring Manager name]’ if you know it, or ‘Dear [Company Name] Hiring Team’ if you don’t. In your introduction, state the position you’re applying for and how you learned about the job opportunity. Briefly mention your key qualifications and why you are a good fit for the role. The introduction should capture the reader’s attention and set the tone for the rest of the letter. It should be concise, enthusiastic, and demonstrate your interest in the position. Make sure your introduction showcases your understanding of the role and your eagerness to contribute to the company. A strong opening will encourage the hiring manager to continue reading and learn more about your qualifications.

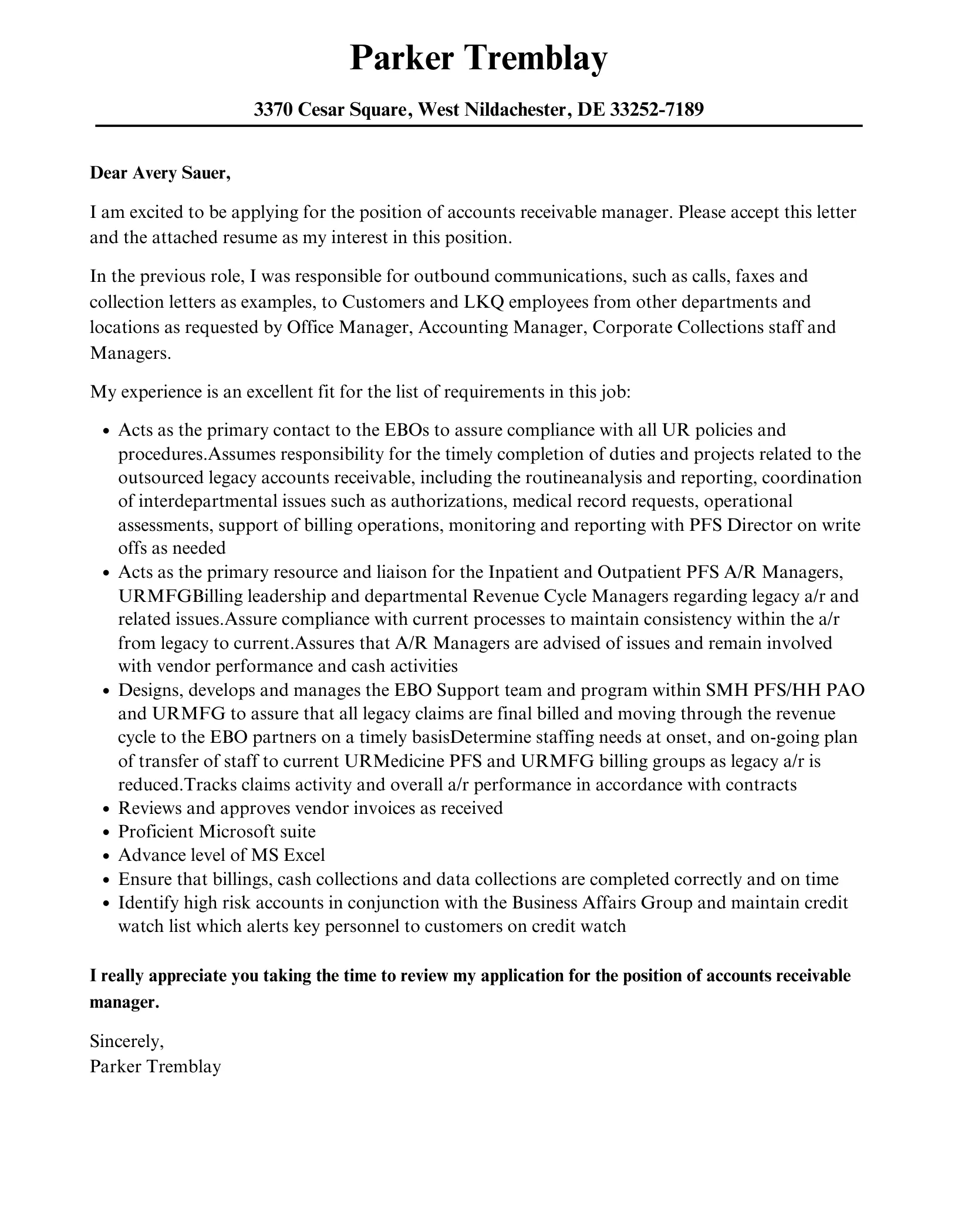

Body Paragraphs

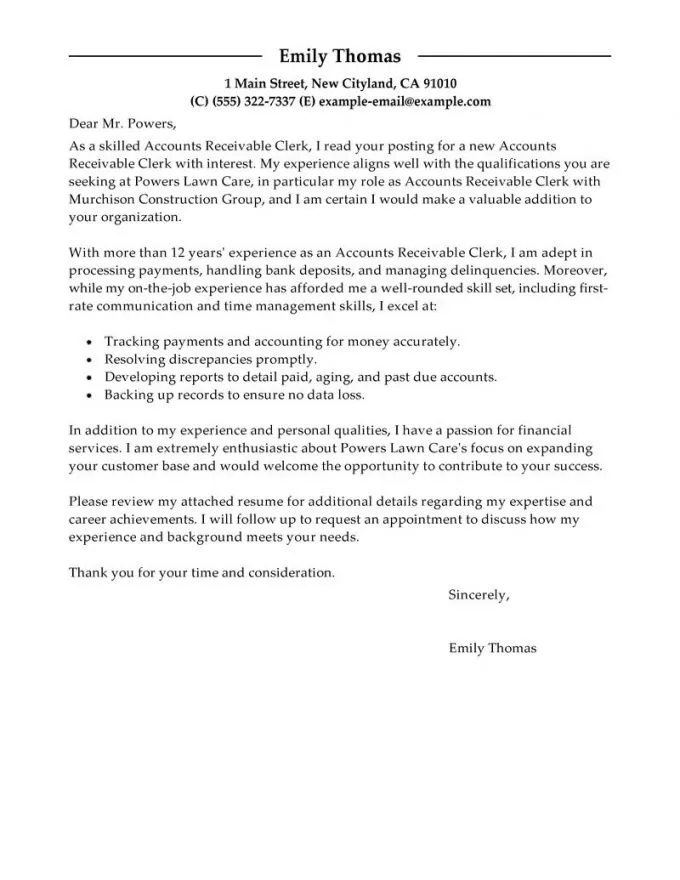

The body paragraphs are where you will showcase your relevant experience, skills, and achievements. Use these paragraphs to provide specific examples of how you’ve handled the key responsibilities of an accounts receivable role. Highlight your experience with accounting software, managing customer accounts, resolving payment issues, and preparing financial reports. Quantify your achievements whenever possible to demonstrate your impact, such as ‘reduced outstanding invoices by 15%’ or ‘improved payment collection rates by 10%’. Tailor the content to match the job description, emphasizing the skills and experiences most relevant to the role. Explain why you are interested in the company and the specific opportunity. The body paragraphs are your chance to persuade the hiring manager that you are the best candidate for the job.

Highlighting Relevant Experience

In your cover letter, be sure to highlight your relevant experience. Focus on past roles where you have performed similar duties. Provide specific examples of your day-to-day tasks, such as managing customer accounts, processing invoices, and handling payment discrepancies. Briefly describe your responsibilities and the outcomes of your work. Use action verbs to showcase your contributions and impact. For instance, instead of saying ‘Responsible for managing accounts,’ try ‘Managed a portfolio of 100+ accounts, ensuring timely payments and resolving customer issues’. This approach will demonstrate your hands-on experience and show the hiring manager your practical capabilities. Be clear and concise, providing only relevant details that align with the job requirements. Use your past experiences to demonstrate your proven success in similar situations.

Quantifying Achievements

Quantifying your achievements is a powerful way to make your cover letter more impactful. Instead of just listing your responsibilities, use numbers to demonstrate the results of your work. For example, use statements such as ‘Improved collection rates by 12% within six months’ or ‘Reduced the number of overdue invoices by 18% through effective follow-up strategies’. Using quantifiable data allows the hiring manager to understand the true value you brought to your previous roles. Consider using metrics like the number of accounts managed, the value of invoices processed, or the time saved through process improvements. Quantifiable achievements make your cover letter more compelling and provide tangible evidence of your capabilities.

Expressing Enthusiasm and Fit

In your cover letter, express your enthusiasm for the role and the company. This is your opportunity to show your interest in the position and your understanding of the company’s mission. Explain why you are excited about the opportunity and what specifically attracts you to the role. Mention what aspects of the job align with your career goals and interests. Showing that you’ve researched the company and understand its values will show that you have thought about how you can contribute to their success. Demonstrate your understanding of the company culture and explain how your skills and personality fit the team. This will boost your chances of getting hired.

Call to Action and Closing

Conclude your cover letter with a call to action. State your interest in an interview and thank the hiring manager for considering your application. You can express your eagerness to discuss your qualifications further and provide your contact information again for easy access. Close with a professional sign-off, such as ‘Sincerely’ or ‘Best regards,’ followed by your full name. Make sure your closing is polite and professional. A strong call to action and a professional closing leave a lasting positive impression and increases your chances of getting an interview. Ensure your closing is error-free to leave a good final impression.

Common Mistakes to Avoid

Avoiding common mistakes can significantly improve your cover letter and increase your chances of getting the job. Many applicants make easily avoidable errors, such as using generic cover letters or focusing on responsibilities rather than achievements. It is also important to carefully check for any typos and grammatical errors. Paying close attention to these common pitfalls will help you create a cover letter that stands out and presents you as a professional and detail-oriented candidate. The goal is to create a polished and effective cover letter that impresses the hiring manager and clearly communicates your qualifications and enthusiasm.

Generic Cover Letters

One of the most common mistakes is using a generic cover letter that could apply to any job. Generic cover letters fail to demonstrate that you have researched the company or understand the specific requirements of the role. Avoid this by tailoring each cover letter to the specific job you’re applying for. Customize your letter by highlighting the skills and experiences that are most relevant to the job description. Show that you understand the company’s mission and values by mentioning them in your letter. By showing your genuine interest in the specific opportunity and the company, you greatly increase your chances of making a strong impression on the hiring manager and demonstrating your dedication.

Focusing on Responsibilities Over Achievements

Another common mistake is focusing too much on your job responsibilities rather than highlighting your achievements. While it is important to mention your duties, it is even more important to showcase the impact you made in each role. Instead of saying ‘Managed accounts receivable,’ try ‘Managed accounts receivable, reducing outstanding invoices by 15%’. The key is to quantify your accomplishments whenever possible, using numbers, data, and metrics to illustrate the value you brought to previous positions. This gives potential employers a clear understanding of your contributions and strengthens your application.

Typos and Grammatical Errors

Typos and grammatical errors can undermine the impression you’re trying to create. They signal a lack of attention to detail, which is a crucial trait in accounts receivable roles. Always proofread your cover letter carefully, and ideally, have someone else review it as well. Misspellings, incorrect punctuation, and grammatical errors can make your letter appear unprofessional and could lead to the immediate rejection of your application. Proofread thoroughly, checking for any errors in spelling, grammar, and punctuation before submitting your cover letter. A clean, error-free document will reflect professionalism, which is essential for any role within finance.

Formatting and Presentation

The format and presentation of your cover letter are just as important as its content. Your cover letter should be easy to read, visually appealing, and professional. Use a clear, professional font and keep the text concise and well-organized. Proofread the letter carefully to eliminate any errors and ensure that your cover letter reflects your attention to detail. A well-formatted and well-presented cover letter shows that you are meticulous and organized, which are qualities valued in accounts receivable.

Using a Professional Font

Choose a professional font for your cover letter. Fonts like Times New Roman, Arial, Calibri, or Georgia are generally considered safe choices. These fonts are clear, readable, and easy on the eyes. Make sure the font size is between 10 and 12 points for the body text and 12 to 14 points for headings to ensure that the letter is easily readable. Avoid using overly stylized or decorative fonts, as they can make your letter look unprofessional. Selecting a professional font reflects your attention to detail and shows that you take the application process seriously.

Keeping it Concise and Readable

Keep your cover letter concise and easy to read. Hiring managers often review many applications, so they appreciate a letter that quickly conveys the most important information. Use clear, straightforward language, and avoid jargon or overly complex sentences. Organize your content logically, using bullet points and headings to break up long blocks of text. Aim for a letter that is no longer than one page. Being concise and keeping your letter readable will capture the hiring manager’s attention and highlight your most relevant skills and achievements effectively.

Proofreading Your Cover Letter

Thorough proofreading is essential before submitting your cover letter. Typos, grammatical errors, and formatting inconsistencies can detract from your qualifications. Read your letter carefully and check for any mistakes. It is also helpful to have someone else proofread your cover letter, as a fresh pair of eyes can often catch errors you might have missed. Ensure that your name, contact details, and the company’s information are accurate. Proofreading ensures that your letter conveys professionalism, attention to detail, and the necessary skills required to excel in accounts receivable.

Tailoring Your Cover Letter

Tailoring your cover letter to each job you apply for is essential. This means customizing your letter to align with the specific requirements and expectations of the role. Research the company, match your skills to the job description, and seek feedback to ensure your cover letter effectively showcases your qualifications. By personalizing your cover letter, you demonstrate your genuine interest in the opportunity and increase your chances of making a strong impression on the hiring manager. Tailoring your cover letter shows you have taken the time and effort to understand the role and the company.

Researching the Company

Before writing your cover letter, research the company. Visit their website, read their ‘About Us’ section, and review their social media profiles. This will give you valuable insights into their mission, values, and culture. Understanding the company’s goals will help you to demonstrate your alignment with their values and highlight how your skills and experience align with their needs. The more you know about the company, the better you can tailor your cover letter to resonate with the hiring manager and showcase your genuine interest in the role and the organization. Tailoring your cover letter to match the company’s values will increase the impact and effectiveness of your application.

Matching Skills to the Job Description

Carefully review the job description and identify the key skills and qualifications the employer is seeking. Then, match your skills and experience to these requirements. Provide specific examples of how you have demonstrated those skills in previous roles. Focus on the skills and experiences that are most relevant to the job. Use the same keywords and phrases from the job description in your cover letter to demonstrate your understanding of the role and make it easier for the hiring manager to see the connection between your qualifications and the job requirements. Matching your skills to the job description is the best way to demonstrate that you are a good fit for the position.

Seeking Feedback

Get feedback on your cover letter from trusted sources before you submit it. Ask friends, family, or career advisors to review your letter and provide constructive criticism. They can offer valuable insights into the clarity, effectiveness, and professionalism of your letter. Pay attention to their feedback and make revisions accordingly. Consider asking someone with experience in accounts receivable or human resources to review your cover letter. Fresh perspectives can often identify areas that can be improved. Getting feedback is essential to refining your cover letter and enhancing its impact.

In conclusion, crafting a winning accounts receivable cover letter requires a strategic approach. By understanding the accounts receivable role, highlighting essential skills, structuring your letter effectively, avoiding common mistakes, and tailoring your cover letter to each opportunity, you can significantly increase your chances of getting hired. Remember to express your enthusiasm, quantify your achievements, and present yourself professionally. Use these top secrets to create a cover letter that makes a lasting impression and opens doors to your career goals. Good luck with your job search!